Multiple possibilities.

A single connection.

The all-in-one platform for all payment processes.

To keep pace with the dynamic world of e-commerce, online retailers need flexible solutions for seamless implementation of new payment methods. collana pay supports multi-PSP and multi-payment method management out of the box and makes your payment processes particularly future-proof.

The key arguments for collana pay

collana pay offers many features for the execution and control of your payment processes. Read here what these are and how your company can benefit from them:

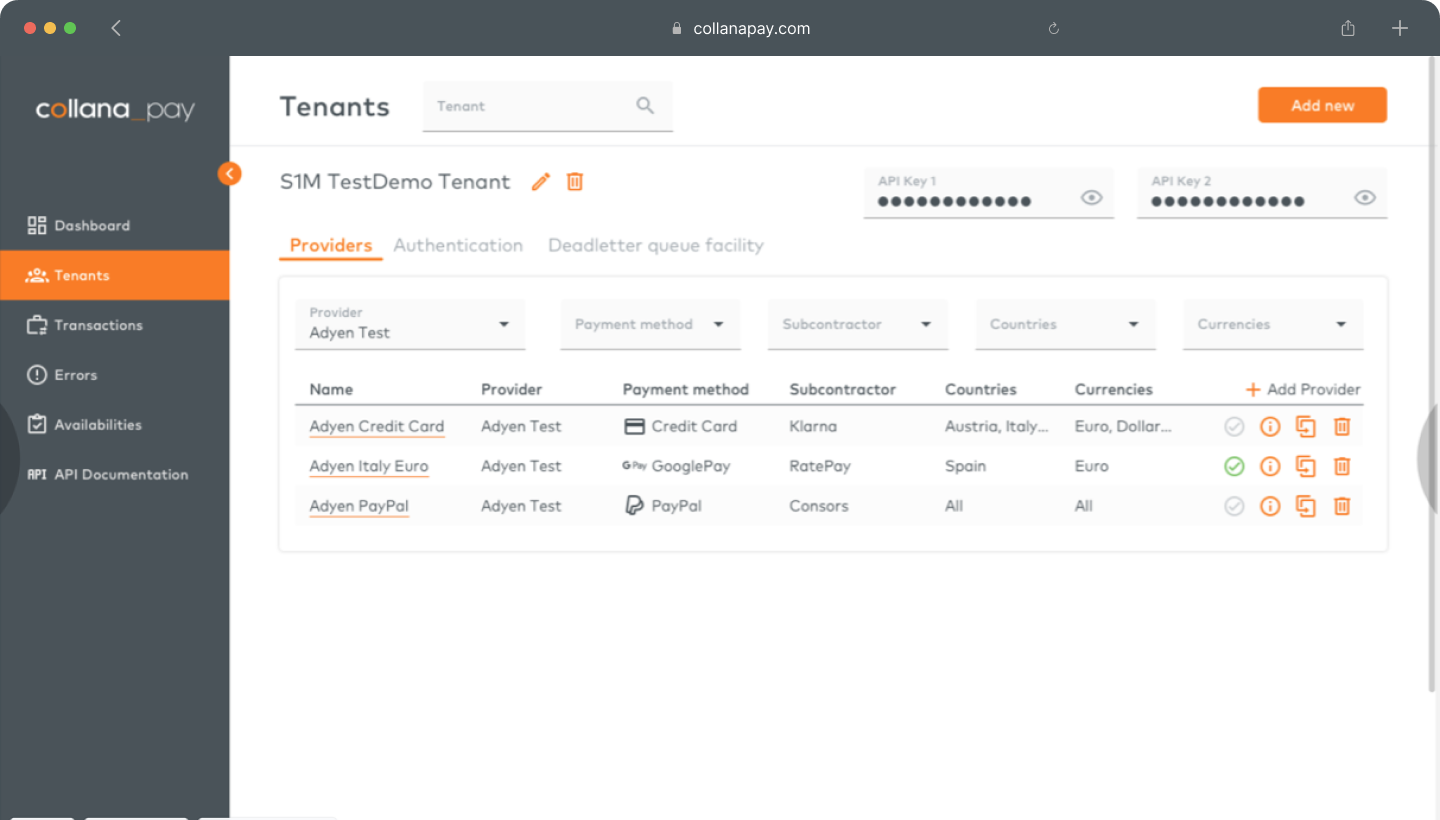

Central multi-payment management provides clarity and an overview

collana pay is a platform for the central administration of all online payments. E-commerce companies can set up and manage various payment methods from different providers (payment service providers) through a single integration to simplify their payment management. This saves time and resources, as businesses no longer need to manage and maintain multiple integrations or interfaces with different payment providers. Our collana pay Admin Portal is the central point for setting up payment methods, error handling and detailed transaction searches. If you use multiple PSPs, you can search for transactions across providers without having to log into different PSP backend systems.

Reduction of development times through standardisation

Once collana pay is implemented in both the shop and ERP system, you will benefit from the PSPs and payment methods already integrated into the collana pay platform. The uniform communication with the collana pay API, regardless of the PSPs used, ensures radical simplification when implementing new PSPs and payment types. This simplification extends to troubleshooting as well, since collana pay consolidates the various error codes and texts from different Payment Service Providers and uniformly presents them to consuming systems such as webshops.

„Since the introduction of collana pay, we can offer new payment methods or payment service providers within a few hours. After that, we can already start with the integration testing. In the past, it used to take us a few weeks for this process."

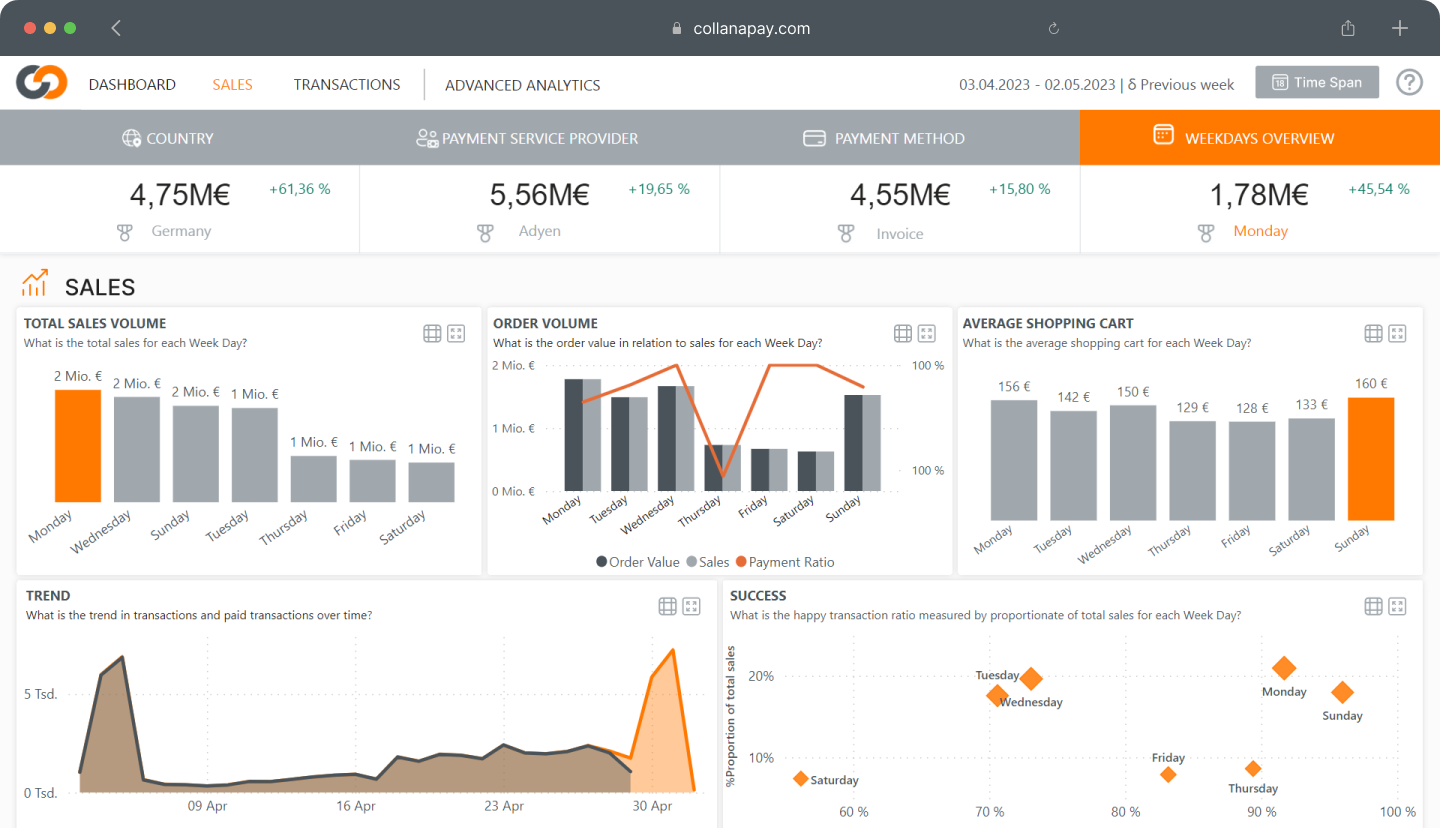

Data analytics provides valuable insights

Get powerful insights and analytics into your payment data and processes. We provide reports via our Power BI app to keep an eye on the most important key figures. Instantly see the changes over a reference period. The following report areas are included:

- Dashboard with key data and trends (e.g., “Happy Transaction” rate)

- Sales charts by country, payment provider, payment method and day of the week

- Transaction evaluations by country, payment provider, payment method and day of the week as well as reasons for non-optimal payment processes (e.g. returns or excessively long process times)

- Advanced analytics reports on trends, shopping basket analyses, geographical evaluations and technical metrics, abandonment rates and rejection rates

collana pay even provides aggregated competitive data for comparisons. You can see if you are performing better or worse than your benchmark and take targeted actions based on the analysis.

Competitive advantages through flexibility and fast go-to-market

Change or expand payment service providers (PSPs) and payment methods without time-consuming and costly changes to the connected systems.

Save time and money with all already available PSPs to conquer new countries with the best payment methods. Existing connectors and plug-ins for online stores and ERP systems guarantee fast and consistent implementation of your desired payment methods.

Multi-PSP strategy to reduce payment default risks

By utilizing multiple payment service providers (PSPs) in parallel, you can significantly reduce the risk of a payment provider failure. The surprising WireCard insolvency serves as a striking reminder of the challenges businesses face in quickly finding and integrating a new provider to ensure uninterrupted payment processing. In the event of an unexpected PSP failure, a multi-PSP strategy (operating at least two PSPs simultaneously) allows you to continue offering payment options to your customers through alternative PSPs.

Cost reduction through easy onboarding and switching possibilities

Take advantage of additional savings effects by using the PSPs and combinations of payment methods with the best price conditions in each case. Local PSPs may be less expensive than some global PSPs or offer additional service at a similar cost.

Available PSPs and payment methods

Under the following link you will find our PSP table. It provides a comprehensive overview of the available payment service providers (PSPs) and payment cards that are integrated into collana pay. Further payment service providers can be added if required. Just get in touch with us!

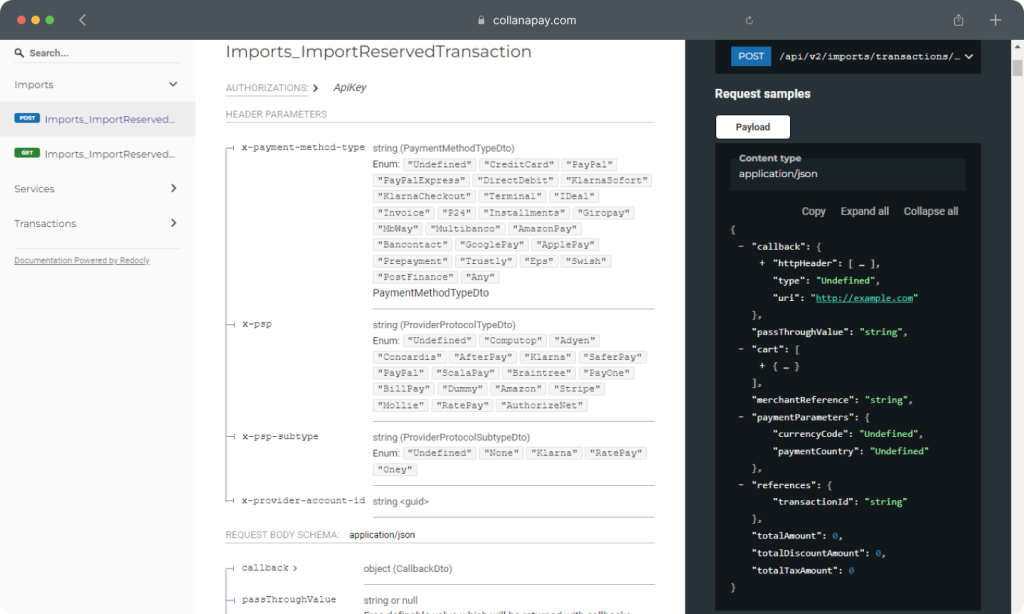

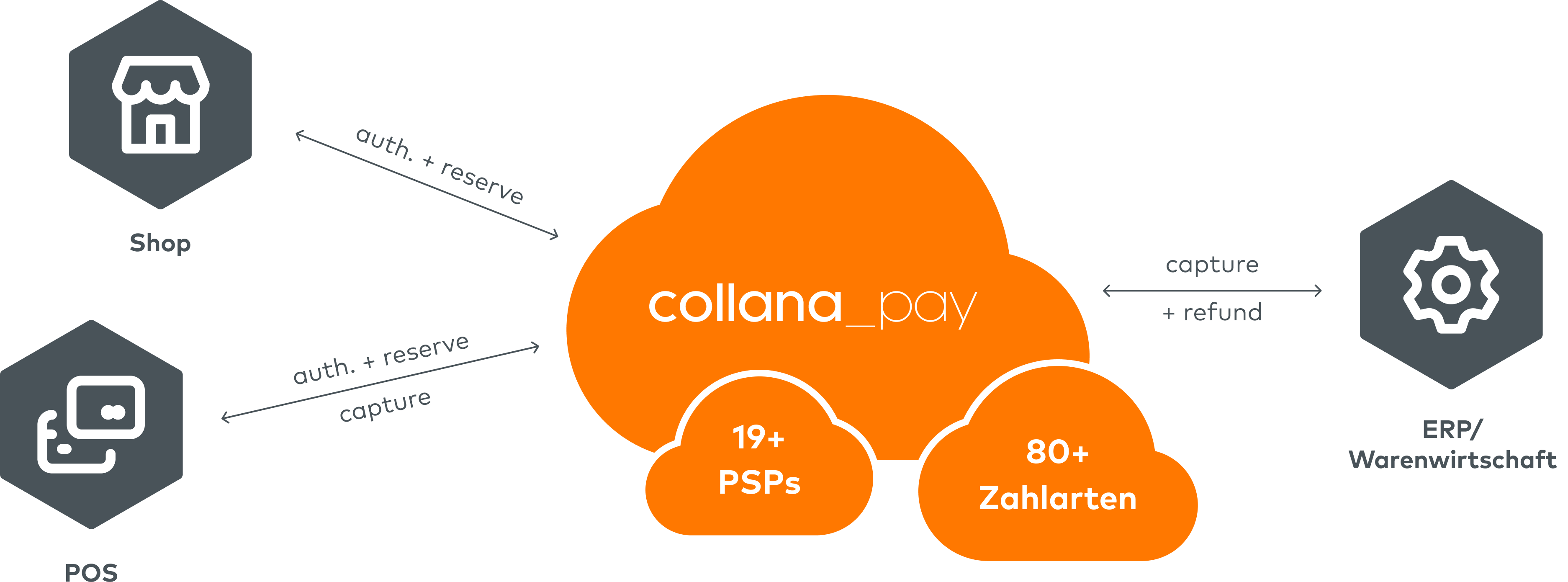

How does collana pay work?

collana pay is designed as a multi-payment processing solution and can be utilized through communication with the collana pay API.

There are two approaches for integration:

Direct API connection

collana pay offers an API with multiple endpoints to control your payment processes. Through direct API integration, you gain maximum control and can implement customized workflows for your payments. This involves developing a custom interface to connect your systems (e.g., shop or ERP system) with collana pay. We refer to this approach as the “API-first concept”. Our API is well documented and provides developers with a quick sense of achievement.

Schedule an online appointment with us. We will be happy to advise you!

When implementing the connection of collana pay to your systems, you can generally pursue two variants:

1. The sales channels are directly connected to collana pay (the ideal way)

Features

- Fully automated and cross-PSP payment processes from the beginning (authentication, authorization) up to refunds without any media disruptions

- Complete data with all process steps are available for analysis in our data analytics

- Quickly switch between payment methods and payment providers. The communication channel is always open.

- Store or POS system are connected directly (intensive development and test phase)

Schedule an online appointment with us. We will be happy to advise you!

2. Sales channels are not connected to collana pay

Features

- The existing PSPs and payment methods integrated into your shop and POS systems do not need to be changed. This saves time and initial development effort

- As soon as collana pay is implemented in the OMS, ERP or Wawi, you benefit from automated downstream payment processes, such as captures for outgoing goods or refunds for returns from your customers

- Data and reports do not show all information, as data is only known in collana pay from the capture onwards (e.g. captures, refunds)

- Flexibility in changing PSPs and payment methods is less supported compared to the 1. approach. New data structures or interfaces may need to be implemented

- Fully automated payment processes not available “out of box”, as in the 1st variant

Schedule an online appointment with us. We will be happy to advise you!

Plug-ins & integrations

Would you like to use collana pay and rely on standard processes? Our existing integrations in leading software solutions from our ISV partners make it easier for you to access your multi-payment strategy. collana pay is an integral part of the shop or ERP solution, or can be easily installed and used at short notice via plug-ins or apps.

"We highly value the flexibility of collana pay, which allows us to quickly and efficiently integrate new payment methods and payment service providers for our target audiences and international markets. This greatly supports our internationalization strategy."